In the footage, a crowd is seen gathered in front of a solid, imposing structure – a bank closed for unknown reasons. The building is a hulking grey edifice, the doors securely shut, guarded by an ominous-looking security system.

The Soviet Union had left behind a considerable external debt that Russia inherited. This burdened the country’s finances and made it difficult to secure international loans.

Some are gesticulating wildly, their faces a mask of frustration and anger, their voices rising in sharp, loud exchanges that cut through the ambient noise. Without warning, the argument escalates into a physical altercation. Fists fly and bodies grapple, with each man trying to assert dominance. Bystanders scatter, creating a space around the brawlers who are now the focus of everyone’s attention. The scene is interspersed with the flashing lights of arriving law enforcement vehicles, their sirens adding to the cacophony. The footage ends with the arrival of the police, who immediately intervene, attempting to restore order to the unruly scene.

The Russian financial crisis in 1993 is a complex subject that is affected by numerous factors

In 1993, Russia faced political turmoil due to a constitutional crisis between the president and parliament, causing instability and shaking investor confidence. The transition to a market economy brought challenges like surging inflation, falling industrial and agricultural production, and poor tax collection. At tvdata.tv, we offer footage that illustrates these events.

- Monetary policy: The Russian Central Bank was printing money to finance the government’s budget deficit, leading to hyperinflation.

- Structural problems: The Russian economy was suffering from serious structural problems, including a lack of infrastructure, corruption, and a failure to establish the rule of law. These problems made it difficult for the economy to function efficiently.

- Shock therapy: The “shock therapy” approach to economic reform, which aimed for rapid marketization and liberalization, caused widespread hardship and dislocation, leading to a significant contraction of the economy.

Fiscal deficit:

The Russian government was spending more than it was taking in, creating a budget deficit. This was partly due to inefficient tax collection and a reluctance to cut spending.

The ensuing financial crisis would have been a time of great difficulty for many Russians leading to the scenes of chaos and confrontation you described earlier.

During the 1993 Russian financial crisis, the scene of chaos in front of the bank, especially among those in poorer economic situations, can be attributed to a mix of factors. The transition to a market economy brought severe inflation, drastically reducing the value of savings and making everyday purchases difficult. This period of economic hardship hit the poorest the hardest, as their financial security vanished overnight. Additionally, instability in the banking sector likely fueled fears of losing what little they had left.

Lack of financial understanding lea to confusion and frustration

Footage of the situation which drove people to desperate measures. Many people might not have fully understood the nature of the financial crisis and who was to blame.The combined pressure of losing life savings and the uncertainty of financial stability pushed many to the brink. It lead to the tumultuous scenes observed.

At TVdata, we have hours of video footage covering this turbulent period.

These videos are showcasing the real impact and atmosphere of the 1993 & 1998 Russian financial crisis.

- Desperation: In a financial crisis, people often face severe hardships, such as job loss, price inflation, and uncertainty about the future. This could have driven people to act out in desperation.

- Social unrest: A financial crisis can also lead to social unrest, as people feel frustrated and unheard. The protest in front of the bank could be an expression of this dissatisfaction.

- Inequality: Economic crises often exacerbate social inequalities. The wealthier people may have resources to weather the crisis, while the poor bear the brunt of the hardship. This inequality can spark anger and lead to conflicts.

- Scapegoating: In times of crisis, it’s common for people to look for someone or something to blame for their misfortune. The closed bank, as a symbol of financial system, could have been a target for people’s frustration.

- Systemic Trap: This could refer to the systemic problems in society that keep people in poverty, making it difficult for them to escape even in times of economic growth.

- Deception or Betrayal: This could reflect feelings of betrayal by institutions, such as the government or the banking system, which they feel have not protected their interests.

Government Failure:

Video Interviews with people on the streets of Russian cities. They blame the government for economic hardships because of perceived mismanagement. They feel the government is not doing enough to alleviate the suffering.

There are always possibilities for different outcomes, depending on a multitude of factors, including but not limited to government policies, international aid and intervention, public response and the resilience of the economy. A change in any of these could have potentially altered the course of the crisis and its impact on the public.

Deception or Betrayal: This could reflect feelings of betrayal by institutions, such as the government or the banking system, which they feel have not protected their interests. tell me more ChatGPT

Certainly, feelings of deception or betrayal from institutions manifested in a variety of ways during times of economic crisis

Trust in the banking system is paramount to its successful operation. However, during financial crises, banks failed and required bailouts. Russian banks enacted policies such as withdrawal limits, frozen accounts and higher interest rates. These measures created feelings of betrayal among the populace, particularly those who find their life savings at risk.

- Government: Governments are expected to manage a country’s economy responsibly and to provide public services. Economic crises often occur when this trust is broken – through fiscal mismanagement, corruption, lack of transparency, or policies that disproportionately affect certain segments of the population. This can create a sense of deception or betrayal, leading to widespread discontent and protests.

- Inequality and Social Mobility: Economic crises often exacerbate existing societal inequalities, creating a sense that the “game” is rigged against those of lower socioeconomic status. The wealthy often have more resources and better means to weather economic downturns, while the poor and middle classes bear the brunt of such events. This can lead to perceptions of betrayal by the system as a whole.

- Lack of Accountability: During or after a crisis, if it appears that those responsible for the mismanagement or risky behaviors that led to the crisis are not held accountable, it can increase feelings of betrayal. This is particularly true if ordinary people face hardship while those at the top seem to escape consequences.

- Broken Promises: If pre-crisis, the government, banks, or other institutions made promises or assurances that were not fulfilled, people may feel deceived. This can occur with pension guarantees, promises of economic stability, or assurances about the security of investments or savings.

These feelings can lead to social unrest, protests, or loss of faith in the system. In some cases, they may also result in significant political shifts or reforms as public pressure mounts for change.

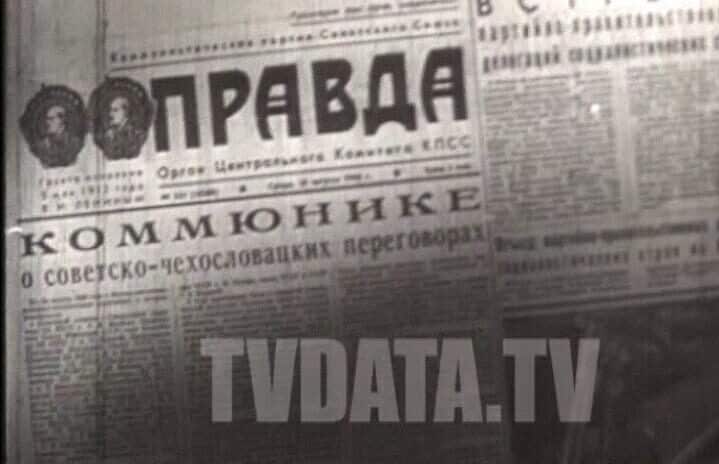

August 25, 1998, was a significant date in Russia’s financial history

it was during the Russian financial crisis, often referred to as the “Ruble Crisis” or the “Russian Default

Here’s a brief background and what happened: In the late 1990s, Russia was undergoing serious economic challenges, including a decline in productivity, a large fiscal deficit, and a fixed exchange rate regime with the lack of foreign reserves to support it. This situation came to a head in August 1998. On August 17, 1998, the Russian government devalued the ruble, defaulted on domestic debt, and declared a moratorium on the payment of foreign debt. This resulted in a sharp increase in inflation, a collapse in the banking system, and a severe contraction of the economy, leading to a significant decrease in living standards for most of the population.

By August 25, 1998, the situation was critical

The value of the ruble was in free fall, causing a surge in inflation. The stock market had collapsed, and many banks were failing. People were queuing up at banks and ATMs in an attempt to withdraw their savings, leading to a run on banks.

This period of economic turmoil resulted in significant political and social repercussions, including the resignation of the then Prime Minister, Sergei Kiriyenko, and his government. Boris Yeltsin, the then President of Russia, was also politically weakened by the crisis. The economic hardship brought on by the crisis was a factor in the increasing popularity of communist and nationalist parties, affecting the political landscape in Russia for years to come.

Experience the historic 1998 Russian financial crisis through our rare, riveting stock footage

Crisis Captured: The tumultuous tides of the 1998 Russian economic meltdown with TVDATA’s exclusive stock footage. Unrest of the ’98 Russian crisis with TVDATA’s unique footage.

- “History in High-Def: From upheaval to unrest, TVDATA brings you striking footage from the 1998 Russian financial crisis.”

- “Retro Russia in Ruin: Relive the unforgettable moments of the ’98 financial crisis with our licensed footage at TVDATA.tv.”

stock footage of the events following the denomination of the ruble in 1998

In this poignant footage, we glimpse into the heart of Russia in 1998, in the wake of the ruble’s denomination. The cityscape buzzes with a strange blend of apprehension and optimism. Long queues curl around banks as citizens clutch bundles of old ruble notes, waiting their turn to exchange them for the new currency. Close-ups of the new ruble notes and coins provide a stark contrast against the now outdated currency. Meanwhile, in quieter corners of the country, resilient locals go about their day, trading goods and services in a throwback to older times, demonstrating the tenacity of the human spirit amid economic upheaval.